Middle East

US Forces Intercept Chinese Cargo Ship Carrying Military Equipment to Iran

U.S. forces have intercepted and seized military equipment from a Chinese cargo ship bound for Iran, marking one of the most significant disruptions of Iran’s rearmament efforts in years and signaling a sharp escalation in Washington’s response to Beijing’s indirect support for Tehran.

According to officials cited by The Wall Street Journal, the operation took place roughly a month ago in the Indian Ocean, near the coast of Sri Lanka. U.S. operatives tracked the vessel, boarded it at sea, confiscated the military cargo, and then allowed the ship to continue its journey. The mission was conducted quietly and remained undisclosed until now.

The seizure represents the first known interception in years of a Chinese-origin vessel en route to Iran by the U.S. military. Neither the name of the ship nor its owner was released, underscoring the sensitivity of the operation and the broader geopolitical implications surrounding China-Iran cooperation.

The interdiction comes amid mounting intelligence concerns that Iran is rebuilding its missile capabilities with external assistance, despite international sanctions.

In October, CNN reported that European intelligence agencies had identified multiple shipments from China to Iran containing more than 2,000 tons of sodium perchlorate—a dual-use chemical critical to the production of ammonium perchlorate, a key oxidizer used in solid-fuel ballistic missiles.

Ammonium perchlorate is central to Iran’s ballistic missile program, enabling the construction of longer-range and more reliable missile systems. Intelligence officials believe the seized cargo was part of a broader logistical pipeline designed to replenish Iran’s military stockpiles following years of sanctions pressure and recent regional confrontations.

The timing of the operation is particularly significant. In late September, the United Nations reimposed “snapback” sanctions on Iran, restoring comprehensive restrictions aimed at preventing Tehran from advancing nuclear-capable weapons and missile technologies.

The U.S. interception signals an intent to actively enforce those sanctions beyond diplomatic channels.

Strategically, the seizure highlights a widening fault line in global security: the quiet but deepening coordination between China and Iran. While Beijing officially denies military support to Tehran, repeated intelligence findings point to Chinese entities supplying critical materials under civilian or commercial cover, exploiting enforcement gaps across international waters.

For Washington, the operation serves multiple purposes—disrupting Iran’s rearmament, testing China’s tolerance for U.S. interdictions, and signaling that maritime corridors linking Asia to the Middle East are now active theaters in a broader geopolitical contest.

As tensions continue to rise across the Red Sea, the Gulf of Aden, and the Indian Ocean, the interception underscores a stark reality: the global struggle to contain Iran’s military ambitions is increasingly inseparable from the strategic rivalry between the United States and China.

Middle East

Iran Jails Critics as Nuclear Talks With US Stay Alive

Iran intensified arrests of political figures and activists on Monday even as it signaled continued openness to nuclear negotiations with the United States, underscoring Tehran’s dual strategy of internal repression and external diplomacy.

The latest detentions followed recent indirect talks between Iranian and U.S. officials in Oman that both sides described as constructive. Among those arrested was Javad Emam, spokesman for the Reformist Front coalition, along with several other reformist figures, activists and filmmakers accused of backing protest statements. The Revolutionary Guards were reported to be behind the arrests.

The crackdown comes weeks after mass protests — among the most serious challenges to the Islamic Republic since 1979 — were violently suppressed. Authorities have branded the unrest “riots” allegedly orchestrated by foreign enemies, including Israel and the United States.

At the same time, Iran’s leadership has kept the diplomatic channel with Washington open. Supreme leader Ayatollah Ali Khamenei urged Iranians to show resolve against outside pressure, framing national strength as a matter of popular will rather than military hardware.

In parallel, Iran hinted at possible concessions on its nuclear programme. State media quoted atomic energy chief Mohammad Eslami as saying Tehran could dilute uranium enriched to 60 percent if sanctions were lifted — a step that would lengthen the time needed to produce weapons-grade material. Iran insists its programme is peaceful, a claim disputed by the U.S., Israel and other Western governments.

The arrests have drawn renewed attention to the fate of prominent dissidents. Nobel Peace Prize laureate Narges Mohammadi was recently sentenced to additional prison time on national security and propaganda charges, despite longstanding health concerns. Hussein Karoubi, son of veteran opposition leader Mehdi Karoubi, was also detained.

The reformist camp, which largely backed President Masoud Pezeshkian in last year’s election, has been hit particularly hard, with several of its senior figures now jailed.

While Washington has focused talks on Iran’s nuclear activities — and potentially its missile programme and regional alliances — it has so far shown little public reaction to the internal crackdown. President Donald Trump has warned of severe consequences if diplomacy fails, even as negotiations continue.

Official figures put the protest death toll at just over 3,100, mostly security personnel, while international groups say the true number of civilian deaths and arrests is far higher. As Iran presses ahead with arrests at home and diplomacy abroad, the contrast highlights a regime seeking relief from sanctions without loosening its grip on dissent.

Middle East

Iran Jails Nobel Laureate Narges Mohammadi for Six Years

An Iranian court has sentenced Nobel Peace Prize laureate and prominent human rights activist Narges Mohammadi to six years in prison on charges of “gathering and collusion to commit crimes,” her lawyer said Sunday, in a ruling that has drawn renewed international concern over Tehran’s treatment of dissenters.

According to her lawyer, Mostafa Nili, Mohammadi was also given an additional 18-month sentence for alleged propaganda activities, a two-year ban on leaving Iran, and ordered into two years of internal exile in the eastern city of Khosf. Under Iranian law, the prison sentences will run concurrently. The verdict can be appealed.

Nili said Mohammadi, who has serious health issues following surgery for a tumour and a bone graft, may seek temporary release on bail to receive medical treatment. Another of her lawyers, Chirinne Ardakani, said the trial was conducted without proper notification and described it as “unfair.”

Mohammadi, 53, has spent much of the past decade in and out of prison for her activism against Iran’s use of the death penalty and compulsory hijab laws. She was last arrested in December in Mashhad after speaking at a memorial ceremony for a lawyer who had been found dead.

Even while incarcerated, Mohammadi has continued to protest, staging demonstrations inside prison and undertaking hunger strikes. She won the Nobel Peace Prize in 2023 for her long-standing advocacy for human rights, with her children accepting the award on her behalf while she remained behind bars.

Human rights groups say the latest sentence underscores Iran’s ongoing crackdown on activists and critics, as the country continues to rank among the world’s leading executioners.

Middle East

US Urges Citizens to Leave Iran as Nuclear Talks Resume

WASHINGTON / MUSCAT — The United States has urged its citizens to leave Iran immediately, citing rising security risks as Washington and Tehran resume high-stakes talks over Iran’s nuclear programme.

The warning came as Steve Witkoff, President Donald Trump’s special envoy, held face-to-face talks with Iranian Foreign Minister Abbas Araghchi in Muscat, Oman, on Friday. The meeting marked the first direct engagement between the two sides since last summer’s 12-day conflict involving Iran, Israel and the United States.

Ahead of the talks, the U.S. virtual embassy in Iran issued a security alert telling Americans to “leave Iran now,” as Washington continues a visible military buildup in the region — a deployment Trump has repeatedly described as an “armada.”

Trump has warned that the U.S. could take military action unless Iran agrees to a new nuclear deal. His administration is pressing for what officials describe as “zero nuclear capacity,” including an end to uranium enrichment and the disposal of Iran’s existing stockpile. Talks are also expected to cover Iran’s ballistic missile programme and its support for regional armed groups such as Hamas and Hezbollah.

White House press secretary Karoline Leavitt said the president has “many options at his disposal,” emphasizing U.S. military power while leaving the door open to diplomacy.

Iran, for its part, said it was prepared to defend itself against what it called “excessive demands or adventurism” by Washington, while insisting it would not miss the opportunity for diplomacy. China, a key Iranian ally, voiced support for Tehran and condemned what it described as U.S. “unilateral bullying.”

The talks come against the backdrop of recent nationwide protests in Iran, which human rights groups say were met with a violent crackdown that killed thousands. Trump initially threatened action over the repression but has since refocused his rhetoric on Iran’s nuclear ambitions.

Vice President JD Vance said the administration would pursue non-military options where possible, but stressed that military force remains on the table.

Iran maintains that its uranium enrichment programme halted after U.S. and Israeli strikes last June, which reportedly caused severe damage to its nuclear facilities and set the programme back by years.

Middle East

Iran and United States Set for Nuclear Talks in Oman as Tensions Remain High

Bombed reactors. Nationwide protests. Open threats of war. Now Iran and the US meet again in Oman — with the nuclear clock ticking.

DUBAI — Iran and the United States are set to hold nuclear talks on Friday in Oman, renewing high-stakes diplomacy over Tehran’s nuclear program following a brief war with Israel and a violent internal crackdown that has left thousands dead and tens of thousands detained.

The talks come amid renewed pressure from Donald Trump, who has warned that the United States could strike Iran if executions of protesters escalate or if Tehran accelerates its nuclear activities. The negotiations revive a diplomatic track that was disrupted in June, when Israel launched a 12-day war against Iran, prompting U.S. airstrikes on Iranian nuclear facilities.

Trump’s Letter and Renewed Pressure

The current round of diplomacy traces back to a letter Trump sent on March 5, 2025, to Iran’s Supreme Leader Ayatollah Ali Khamenei, urging negotiations while warning of severe consequences if talks failed.

“I hope you’re going to negotiate,” Trump said in a televised interview the following day, adding that military action would be “a terrible thing” if diplomacy collapsed.

While Trump has intensified sanctions since returning to office, he has also framed negotiations as a last chance to avert further conflict. Khamenei, however, has repeatedly warned that Iran would retaliate against any attack, particularly as the Islamic Republic faces its gravest internal crisis in decades.

Oman’s Mediation Role

The talks will again be mediated by Oman, a longtime diplomatic intermediary between Washington and Tehran. Previous discussions involved Iran’s Foreign Minister Abbas Araghchi and U.S. Middle East envoy Steve Witkoff, including rare face-to-face meetings.

Negotiations stalled last year over uranium enrichment. U.S. officials insist Iran must abandon enrichment entirely, while Tehran maintains it will not surrender what it calls its sovereign right to peaceful nuclear technology. That impasse was overtaken by the outbreak of war in June.

War, Protests and Nuclear Setbacks

Israel’s June offensive, followed by U.S. strikes, targeted Iranian nuclear facilities. In November, Tehran acknowledged it had halted uranium enrichment after the attacks, though inspectors from the International Atomic Energy Agency have not been able to fully assess the damage.

Soon after, Iran was engulfed by nationwide protests triggered by the collapse of its currency. The demonstrations escalated into a broader uprising, met by a sweeping security crackdown that human rights groups say killed thousands.

Nuclear Concerns Persist

Iran insists its nuclear program is peaceful, but Western governments remain deeply concerned. Tehran is currently enriching uranium to 60% purity, close to weapons-grade levels — an unprecedented step for a country without declared nuclear weapons.

Under the 2015 nuclear deal, Iran was limited to 3.67% enrichment and a stockpile of 300 kilograms. The IAEA now estimates Iran’s stockpile at nearly 9,870 kilograms, including material enriched to high levels.

U.S. intelligence agencies say Iran has not yet launched a weapons program but has taken steps that could allow it to build a nuclear device if it chooses.

Decades of Hostility

Relations between Iran and the United States have been hostile since the 1979 Islamic Revolution, which toppled the U.S.-backed Shah and led to the 444-day hostage crisis at the American embassy in Tehran. Since then, relations have oscillated between confrontation and cautious diplomacy, peaking with the 2015 nuclear agreement before Trump withdrew from it in 2018.

Friday’s talks in Oman reopen a diplomatic channel at a moment of extreme volatility — with Iran weakened militarily and politically, the United States escalating pressure, and the prospect of wider conflict still looming over the region.

Middle East

Trump vs. Maliki: Iraq Caught Between Sovereignty and Sanctions

Washington is warning. Baghdad is pushing back. Iraq’s next prime minister could decide far more than its next government.

Former Iraqi prime minister Nouri al-Maliki has chosen defiance over retreat after U.S. President Donald Trump publicly threatened to withdraw American support for Iraq should Maliki return to power, thrusting Iraq’s fragile political transition into an openly geopolitical confrontation.

Maliki, formally nominated last week by the Shiite-dominated Coordination Framework, rejected what he called “blatant American interference” and framed Trump’s warning as a violation of Iraqi sovereignty. “We will continue,” he said, “out of respect for the national will and the Coordination Framework’s decision.”

Trump’s intervention was unusually direct. In a social media post, he blamed Maliki’s previous tenure for plunging Iraq into “poverty and total chaos,” warning that if Maliki returns, the United States would end its assistance, leaving Iraq with “ZERO chance of success, prosperity, or freedom.” The message was unambiguous: Maliki is unacceptable to Washington.

Behind the rhetoric lies a familiar fault line. U.S. officials view Maliki as closely aligned with Iran, and his last term, which ended in 2014, coincided with the rise of the Islamic State, which seized large swaths of Iraqi territory. Even before Trump’s public threat, members of the Coordination Framework received a written warning from U.S. Charge d’Affaires Joshua Harris, recalling that Maliki’s earlier governments were viewed “negatively in Washington.”

Iraq’s domestic politics have only deepened the uncertainty. Caretaker Prime Minister Mohammed Shia al-Sudani, whose bloc won the most seats in November’s parliamentary elections, stepped aside earlier this month, clearing the path for Maliki after both men competed for the Coordination Framework’s backing. A parliamentary session to elect a president — a prerequisite for appointing a prime minister — collapsed this week for lack of quorum, with no new date announced.

The impasse has emboldened armed actors. Leaders of Iran-aligned militias, including Kataib Sayyid al-Shuhada, denounced Trump’s comments as foreign meddling. Their rhetoric echoes a broader fear in Baghdad: that Washington could translate threats into financial pressure. Iraq’s foreign currency reserves are held at the U.S. Federal Reserve, giving Washington significant leverage through sanctions or restrictions on dollar access.

Analysts warn the economic consequences could be severe. Royal United Services Institute fellow Tamer Badawi argues Iraq “cannot afford” Trump following through, but cautions that Maliki’s troubles do not automatically clear the way for Sudani. Instead, he says, Maliki’s nomination may be a tactical gambit — drawing U.S. pressure and domestic resistance while opening space for a third, compromise candidate to emerge.

The irony is that cooperation between Washington and Baghdad continues even as the political temperature rises. The U.S. and Iraq have just completed another transfer of suspected Islamic State detainees from Syria to Iraqi custody, underscoring how security interdependence persists regardless of leadership disputes.

What makes this moment different is visibility. Past U.S. influence over Iraqi politics often operated through private channels. Trump has chosen public confrontation, transforming a domestic power struggle into a test of sovereignty versus survival.

For Iraq, the choice ahead is stark. Defying Washington may satisfy nationalist instincts but risks financial and diplomatic isolation. Yielding could preserve stability but deepen perceptions of external control. As parliament remains paralyzed and candidates jockey for position, the country is again caught between regional loyalties and global pressure — with its next prime minister poised to determine which cost Iraq is willing to pay.

Comment

When Pressure Comes, Putin Lets Iran Burn Alone

Putin’s Calculated Distance from Iran Exposes the Limits of Russia’s Alliances.

Alliances built on convenience rarely survive real pressure. The current standoff between Washington and Tehran has laid bare a quiet but telling shift: Vladimir Putin, long portrayed as Iran’s strategic patron, is now carefully stepping aside as the Islamic Republic faces one of its gravest moments in decades.

As President Donald Trump warns that a U.S. naval armada is moving toward the Gulf and openly hints that strikes on Iran remain an option, Moscow’s response has been conspicuously restrained. Russia’s foreign ministry has advised its citizens against traveling to Iran. Russian officials have offered mediation rather than protection. And the Kremlin has made no move suggesting it would place itself between Tehran and Washington.

This is not accidental. It is strategic abandonment.

For over a decade, Russia and Iran forged a partnership built on opposition to Western power. That relationship deepened after Moscow’s invasion of Ukraine, when Iran supplied Russia with Shahed kamikaze drones that helped sustain the Kremlin’s campaign against Ukrainian cities. In return, Tehran expected unprecedented military cooperation, including advanced aircraft and air defense systems.

Yet the partnership was always transactional, never existential.

Russia localized drone production by 2023, reducing its dependence on Iranian supply. China and North Korea now matter far more to Moscow’s war effort. And the collapse of the Assad regime in Syria in late 2024 — a regime jointly propped up by Russia and Iran — dealt a severe blow to their shared regional architecture.

Even their much-vaunted “comprehensive strategic partnership treaty” signed in early 2025 stopped short of any mutual defense obligation. That omission now looks deliberate. Russia wants flexibility, not entanglement.

The moment of truth came last summer when Israel and later the United States systematically dismantled Iran’s air defenses and struck its nuclear infrastructure — humiliating Tehran in full view of the world. Iranian envoys rushed to Moscow. They returned empty-handed.

Now, as protests sweep Iran and the regime faces mounting internal and external pressure, Putin has again chosen distance over loyalty. His priority is not Tehran’s survival. It is staying in Trump’s good graces as negotiations over Ukraine intensify. By letting the foreign ministry issue ritual condemnations while avoiding concrete commitments, Putin shields himself from consequences while signaling to Washington that Iran is expendable.

Even the limited Russian support visible — a handful of military cargo flights and vague arms assistance — falls far short of what would meaningfully alter Iran’s fate. Moscow cannot spare systems from Ukraine, and it will not risk escalation for a partner whose core survival is not tied to Russia’s own.

This moment exposes a deeper truth about Putin’s world: Russia’s partnerships are designed to be reversible. Loyalty flows upward, never reciprocally.

For Washington, this is an opportunity. Not merely to isolate Iran, but to demonstrate to Russia’s other partners that when pressure arrives, the Kremlin’s friendship has a sharp expiration date.

Putin’s silence today may echo far beyond Tehran.

Middle East

Trump Moves Warships as Iran Nuclear Tensions Return

Trump Warns Iran on Nuclear Reset as U.S. Carrier Group Deploys to Middle East.

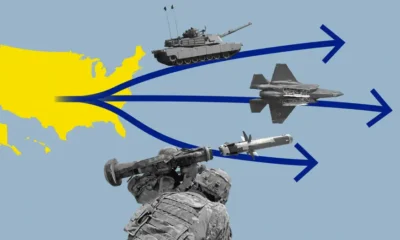

WASHINGTON / DAVOS — The United States is deploying a major aircraft carrier strike group and additional military assets to the Middle East as President Donald Trump warned Iran against resuming its nuclear program, signaling a renewed phase of pressure on Tehran amid lingering regional instability.

Two U.S. officials confirmed Thursday that the aircraft carrier USS Abraham Lincoln, accompanied by several destroyers and fighter aircraft, is moving toward the region from the Asia-Pacific. One official said additional U.S. air defense systems are also under consideration, reflecting heightened alert levels across U.S. military commands.

The deployment comes as Trump has sought to balance deterrence with restraint. Speaking Wednesday from Davos, Switzerland, Trump said he hoped to avoid further military action but made clear that any Iranian attempt to revive its nuclear program would prompt a swift response.

“They can’t do the nuclear,” Trump told CNBC. “If they do it, it’s going to happen again,” he added, referencing U.S. airstrikes on Iranian nuclear facilities carried out in June 2025.

Although U.S. officials emphasize the buildup is defensive, analysts note that similar troop surges preceded last year’s strikes on Iran’s nuclear infrastructure. The Pentagon has previously acknowledged keeping its military intentions secret during that operation.

Iran’s nuclear status remains murky. The International Atomic Energy Agency has not verified Iran’s stockpile of highly enriched uranium for more than seven months, despite guidelines calling for monthly inspections. Before inspections were disrupted, Iran was estimated to hold more than 440 kilograms of uranium enriched to 60 percent purity—near weapons-grade levels—enough material for roughly ten nuclear bombs if further refined.

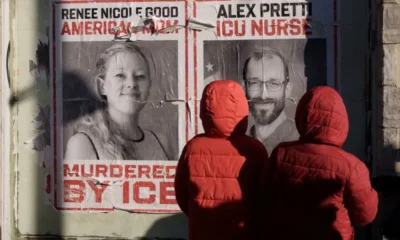

Tehran is also under growing international scrutiny for its violent suppression of protests that erupted in late December over economic grievances. According to the U.S.-based Human Rights Activists News Agency (HRANA), at least 4,519 people have been killed so far, including more than 4,200 protesters. An Iranian official has acknowledged more than 5,000 deaths, including security personnel.

Trump had earlier threatened military intervention over the killings but has softened his rhetoric in recent weeks as protests subsided. However, the military deployment signals Washington remains deeply wary of both Iran’s internal instability and its nuclear ambitions.

The arrival of U.S. warships now places additional pressure on Tehran at a moment when diplomacy, deterrence, and military preparedness are again converging in the Middle East.

Middle East

Gaza: Trump Chairs Board as Turkey and Qatar Enter Post-War Governance

White House Confirms Gaza Board of Peace With Turkish and Qatari Representatives as Trump Leads Transition Framework.

The White House has formally unveiled the architecture of a new post-war governance system for Gaza, confirming the creation of a Gaza Board of Peace (BoP) chaired by Donald Trump and supported by a multinational executive and security structure that includes Turkey and Qatar.

The move signals a decisive shift away from interim crisis management toward a long-term, externally supervised transition designed to dismantle Hamas, rebuild Gaza’s institutions, and stabilize daily life in the enclave.

According to the announcement, the BoP will serve as the political authority overseeing Gaza’s reconstruction and demilitarization. Its seven founding executive members include Marco Rubio, Steve Witkoff, Jared Kushner, Tony Blair, Marc Rowan, Ajay Banga, and Robert Gabriel—an unusually corporate-heavy lineup reflecting Washington’s emphasis on technocratic governance and economic reconstruction.

Operational authority inside Gaza will rest with a newly formed National Committee for the Administration of Gaza (NCAG), led by technocrat Ali Sha’ath, tasked with restoring public services, rebuilding civil institutions, and laying the groundwork for self-sustaining governance. Former UN Middle East envoy Nickolay Mladenov will act as High Representative on the ground, linking the political board with the technocratic administration.

Security will be enforced by an International Stabilization Force (ISF) commanded by Jasper Jeffers, whose mandate includes demilitarization, protection of reconstruction efforts, and securing humanitarian corridors.

Notably, the Gaza Executive Board introduces regional stakeholders directly into Gaza’s governance framework. Confirmed members include Hakan Fidan, Qatari diplomat Ali Al-Thawadi, Egypt’s General Hassan Rashad, UAE Minister Reem Al-Hashimy, Yakir Gabay, and Sigrid Kaag.

Trump framed the initiative as backing a “Palestinian technocratic government” during Gaza’s transition—language that carefully avoids sovereignty questions while asserting external control over security and reconstruction.

Strategically, the framework reflects three realities: Hamas is being formally removed from governance; Gaza’s future is being internationalized rather than Arabized alone; and Turkey and Qatar—long accused by critics of shielding Hamas politically—are now being absorbed into a US-led structure rather than operating independently.

For the region, this is not merely a rebuilding plan. It is a reordering of power, accountability, and influence in post-war Gaza—designed in Washington, enforced internationally, and managed by technocrats under close supervision.

-

Interagency Assessment2 months ago

Interagency Assessment2 months agoTOP SECRET SHIFT: U.S. MILITARY ORDERED INTO SOMALILAND BY LAW

-

Somaliland4 months ago

Somaliland4 months agoSomaliland Recognition: US, UK, Israel, and Gulf Bloc Poised for Historic Shift

-

Minnesota1 month ago

Minnesota1 month agoFraud Allegations Close In on Somalia’s Top Diplomats

-

Middle East2 months ago

Middle East2 months agoSaudi Arabia vs. UAE: How The Gulf Rivalry is Heating Up

-

American Somali3 months ago

American Somali3 months agoWhy Frey Won a Significant Share of the Somali Vote Against a Somali Opponent

-

Middle East2 months ago

Middle East2 months agoTurkey’s Syria Radar Plan Triggers Israeli Red Lines

-

Editor's Pick1 month ago

Editor's Pick1 month agoWhy India Is Poised to Become the Next Major Power to Recognize Somaliland

-

The Million-Follower Exile2 months ago

The Million-Follower Exile2 months agoWhy America Deported Its Most Famous Somali TikTok Star And Who Paid The Price