Editor's Pick

Why the U.S. Is Turning Abandoned Prisons into ICE Detention Centers

Across the United States, long-shuttered prisons — some with histories of abuse, neglect, and civil rights violations — are being quietly reopened to serve as new detention centers for immigrants under the custody of U.S. Immigration and Customs Enforcement (ICE). What had once been facilities closed by local authorities for failing basic standards are now being repurposed amid a historic surge in immigration enforcement.

The Trump administration has dramatically expanded immigration detention as part of its effort to accelerate deportations and “secure the border,” creating a demand for tens of thousands of additional beds beyond the federal government’s existing infrastructure. To meet that demand, ICE has reportedly turned to private prison companies to reactivate previously inactive facilities that had been mothballed — despite troubling past records.

According to El País, facilities such as the North Lake Correctional Facility in Michigan and the Midwest Regional Reception Center (MRRC) in Kansas have been reopened or are being pressed into service to house migrants, with private operators CoreCivic and GEO Group securing no-bid federal contracts to run them. Those companies have histories of civil rights complaints and oversight failures, raising alarms among activists and human rights groups who say the expansion risks repeating past abuses under a new designation. EL PAÍS English

Critics note that these facilities were closed for reasons including systemic understaffing, dangerous conditions, and, in some cases, documented violence and neglect — conditions that civil liberties organizations fear will resurface once inmates are again confined behind their walls. El País reports that reopening such centers has boosted stocks for CoreCivic and GEO Group even as advocacy groups warn that “cashing in” on immigrant detention escalates a system already under heavy scrutiny.

Local Governments Left in the Dark

In some communities, local officials say they have little information about whether or how these closed prisons might be repurposed. In Colorado, KUNC reported that mayors and county administrators in several towns learned only through news coverage that ICE had expressed interest in reopening shuttered private prisons to detain immigrants. Contracts with private operators, they said, would not require local approval, leaving communities unsure about what might come.

Officials in towns like Walsenburg and Hudson noted they had no direct notice of federal plans, and that private prison companies had approached ICE about potential contracts, but the details remained unclear. In some instances, companies had begun advertising for detention staff positions contingent on facilities being revived — a sign that momentum toward reopening is building even without clear community buy-in.

A Broader Pattern of Expansion

This push to reopen old facilities fits into a larger federal strategy of rapidly expanding detention capacity. ICE has historically relied on private prison companies to provide space beyond what the government operates directly, but the sheer scale of reopened sites and the speed with which they are being repurposed have alarmed advocates. Public records and reporting suggest that ICE already detains most immigrants in facilities run by for-profit contractors with longstanding criticisms for poor treatment and oversight, according to the Brennan Center for Justice and other watchdog organizations.

Civil liberties groups argue that rather than investing in humane alternatives to detention or addressing root causes of migration, the federal government is doubling down on a punitive model that echoes the broader U.S. carceral system. The specter of reopening prisons that had been closed due to poor conditions or community opposition raises questions about whether lessons from past failures have been learned — or simply ignored in the rush to expand capacity.

Human Rights and Policy Implications

With immigration arrests and detention numbers far outpacing historical norms, reopening old prisons signals a shift toward scaling up enforcement infrastructure at a time of sharp debate over immigration policy. Critics worry that the human cost of detention — including inadequate medical care, isolation, and limited oversight — will be repeated if new safeguards are not implemented. Meanwhile, many communities remain largely unaware of how federal decisions will affect local resources and social dynamics.

At the core of the controversy lies a broader question about American values and civil liberties: can a system that expands detention capacity without robust accountability, transparency, and respect for human dignity truly claim to protect the rule of law?

In the process of reopening these shuttered prisons for ICE use, some fear the answer is slipping further away.

Editor's Pick

Minnesota Police Chief Intervenes After Masked ICE Agents Detain U.S. Citizen at Gunpoint

When armed men with no badges pull guns on a citizen, the line between law enforcement and lawlessness collapses.

A Minnesota police chief was forced into an extraordinary intervention after masked federal immigration agents detained a U.S. citizen at gunpoint in what critics are calling an unlawful and deeply dangerous roadside operation—an incident now fueling nationwide outrage over ICE conduct.

Dashcam footage obtained by local media shows three unidentified, masked men in an unmarked vehicle swerving to block a lone woman driving in Minnesota, forcing her to stop. The men immediately exited their car with weapons drawn, shouting commands while failing to identify themselves as law enforcement or present any warrant. The woman was dragged from her vehicle, pinned to the ground, handcuffed, and detained. She was not read her Miranda rights.

The woman, who requested anonymity, told reporters she suffered cuts and bruises during the encounter. The footage, later shared with MPR News, shows a scene indistinguishable from a violent abduction—masked men, no visible insignia, guns drawn in public traffic.

The situation began to unravel when the woman’s husband arrived and challenged the legality of the detention. One federal agent reportedly dismissed the concern outright: “I’m not getting into the legality of everything.”

The turning point came after the husband contacted his attorney and spoke with Matt Grochow, the police chief of St. Peter, whom he had known for years. Shortly afterward, the federal agents abruptly reversed course while transporting the woman toward the Twin Cities.

“ICE returned the female to our police department,” Grochow later confirmed in a statement. “I saw her, and I gave her a ride home.”

The City of St. Peter was careful to state that it did not interfere in federal enforcement actions, but acknowledged that Grochow ensured the resident’s safety and transport—an unusually direct local response to federal conduct.

The Department of Homeland Security issued a sharply contrasting account, labeling the woman an “agitator” who was allegedly stalking and obstructing law enforcement. DHS claimed officers attempted a routine traffic stop using emergency lights, and that the woman drove recklessly, ran stop signs, and attempted to ram law enforcement vehicles—assertions not clearly supported by the publicly released footage.

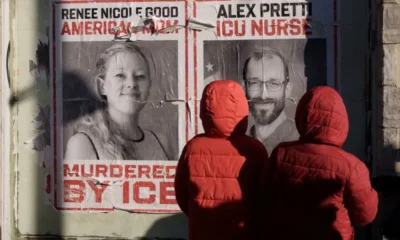

Public reaction was swift and unforgiving, especially given the context. The incident follows the recent fatal shootings of U.S. citizens Renee Good and Alex Pretti during federal immigration operations in Minneapolis.

Commentators across the political spectrum condemned the tactics. Technology journalist Charles Arthur wrote that the scene was “indistinguishable from a kidnapping.” Author Seth Abramson described the agents as “masked highwaymen,” warning that nothing about the footage resembled modern American policing. Science fiction writer Ramez Naam called ICE a “rogue and criminal agency,” urging its dismantling.

In response to mounting backlash, border czar Tom Homan assumed direct control of ICE operations in Minnesota last week, promising “massive changes.” Federal commander Gregory Bovino was suspended following Pretti’s killing. President Donald Trump initially pledged to de-escalate tensions—then reversed course, insisting there would be “no pullback.”

Homan has since emphasized professionalism and accountability, but the Minnesota incident has sharpened a central question now confronting Congress, courts, and the public: when federal agents operate masked, unmarked, and unaccountable, who protects citizens from the state itself?

The footage does more than expose a single encounter. It crystallizes a broader crisis of legitimacy—one in which immigration enforcement, once framed as policy, is increasingly perceived as coercive power untethered from constitutional restraint.

Editor's Pick

Pirates Return: The Horn’s Ports Become the World’s New Battleground

Horn of Africa’s Lawless Seas: Piracy, Smuggling and the New Scramble for Strategic Ports.

In the waters stretching from the Red Sea to the western Indian Ocean, an old threat is resurfacing just as a new contest for influence accelerates. A recent study by the International Institute for Strategic Studies argues that the Horn of Africa is entering a volatile maritime moment where piracy, weapons trafficking and geopolitical rivalry are converging rather than fading.

For years, heavy international naval patrols and tighter security on commercial vessels pushed Somali piracy into decline. That lull bred complacency. Warships redeployed to other crises, shipping companies relaxed costly protective measures, and global attention shifted to missile and drone attacks farther north in the Red Sea. Into that gap stepped a new generation of Somali pirate networks, exploiting familiar weaknesses on land and at sea.

This revival is not simply a criminal flare-up. It is rooted in Somalia’s unfinished state-building project. Political fragmentation, armed insurgency and weak coastal governance continue to deny many coastal communities lawful livelihoods and effective policing. As long as those land-based drivers persist, the report suggests, piracy will keep finding oxygen, even if it never returns to its dramatic peaks of the past.

Running parallel to piracy is a quieter but potentially more dangerous trade across the Gulf of Aden. Smuggling routes linking the Horn of Africa and Yemen have thickened into a dense commercial web moving weapons, components and dual-use technology. State-backed shipments blend with purely profit-driven trafficking. Ideology matters less than access and margins. The result is that armed groups on both sides of the water gain not only hardware but know-how, especially in missiles and unmanned systems. Techniques migrate along the same routes as parts.

At the same time, the region’s ports have become objects of intense courtship. Global powers, Gulf monarchies and ambitious regional states all seek footholds along these coasts. Yet the study cautions against a simple great-power chessboard narrative. The United States and China largely coexist uneasily rather than clash directly. Many announced projects remain tentative for years. Deals materialize only when local authorities see advantage.

That local leverage is the report’s central insight. Somalia, Somaliland and Djibouti are not passive arenas. Their leaders actively play suitors against each other to extract investment, security guarantees and political support. Port politics is therefore layered and transactional, not a straightforward foreign takeover of strategic harbors.

This balancing act is getting harder. Turkey’s growing maritime role in Somalia, Russian interest in a regional naval presence, and Ethiopia’s renewed push for sea access all add friction. Internal Somali politics, including tensions around upcoming national elections and the persistent fight against al-Shabaab, feed directly into maritime risk. Disputes on land spill outward to the shoreline.

Two late developments underline how fast the ground is shifting. Israel’s recognition of Somaliland and Somalia’s subsequent cancellation of security and port agreements with the United Arab Emirates promise to redraw parts of the maritime map. Their full impact is still unfolding, but they illustrate how diplomatic moves on land can instantly ripple across docks and sea lanes.

The picture that emerges is not a single looming showdown but a crowded, fluid contest. Piracy’s return exposes unresolved governance failures. Smuggling networks knit together distant wars. External powers probe for access but must bargain with local gatekeepers. In the Horn of Africa, the sea is not lawless because no one cares. It is lawless because too many actors, near and far, care at once, and none can impose order alone.

Editor's Pick

Germany Fortifies Its Power Grids and Supply Chains

Germany isn’t at war—but it’s acting like a target. And that distinction now matters less than ever.

Germany has taken a decisive step toward hardening its critical infrastructure, passing new legislation amid mounting fears that rising tensions with Russia are translating into sabotage, cyberattacks, and hybrid warfare on European soil.

On Thursday, lawmakers approved a sweeping security package requiring power utilities, water suppliers, food distributors, and even some supermarket chains to reduce their vulnerability to terrorism, espionage, industrial accidents, natural disasters, and public health emergencies. The law brings Germany into line with new European Union resilience directives and marks one of Berlin’s most significant domestic security shifts since the Cold War.

“Germany is not at war, but we are the target of hybrid warfare,” Interior Minister Alexander Dobrindt told parliament ahead of the vote. “Sabotage, espionage, aggression by foreign powers, terrorism—we have a responsibility to ensure resilience.”

The legislation applies to roughly 1,700 operators providing essential services to at least 500,000 people, spanning sectors such as energy, water, food, health, transport, telecommunications, financial services, IT, and waste disposal. Companies will be required to upgrade physical security and alarm systems, conduct regular risk assessments, train staff, and report incidents to Germany’s civil protection authorities within 24 hours.

The political urgency was sharpened by a recent incident in Berlin, where a midwinter arson attack on a high-voltage power cable plunged tens of thousands of households into darkness for nearly a week. The blackout disrupted mobile networks, heating systems, and local rail services, highlighting how quickly infrastructure failures can cascade. The attackers, a far-left militant group calling itself the “Vulkangruppe,” claimed responsibility, prompting public outrage and a government offer of a €1 million reward for information leading to arrests.

Dobrindt argued that such attacks demonstrate the need to rethink openness around sensitive systems. “We must shift from transparency toward greater resilience,” he said, signaling plans to limit public access to detailed infrastructure data such as online maps of power grids—information security experts warn could be exploited by hostile actors.

Germany’s move comes as Europe’s largest economy reassesses its domestic defenses after decades of relative stability. As a major supporter of Ukraine and a central logistics hub for NATO, Germany has become increasingly exposed to retaliatory or destabilizing actions linked to Russia.

Defense Minister Boris Pistorius has warned of a surge in hybrid attacks across Europe, citing cyber intrusions, data cable sabotage in the Baltic Sea, drone-based espionage, and coordinated disinformation campaigns. These threats, he said, are already disrupting supply chains, energy security, and private-sector operations.

Not everyone is convinced the new law goes far enough. Konstantin von Notz, a security expert from the Greens, called the package “too little, too late,” arguing Germany remains “miles away” from uniform protection of its critical infrastructure.

Security specialists, however, stress that absolute protection is unrealistic. Daniel Hiller of the Fraunhofer Institute noted that modern infrastructure systems are so interconnected that resilience depends less on impenetrability and more on redundancy and contingency planning. “Anyone claiming 100% protection is possible is misleading the public,” he said.

That view is echoed by Sabrina Schulz of the European Initiative for Energy Security, who argues that building backups and rapid recovery capacity may matter more than fortifying individual assets. As Chancellor Friedrich Merz pledges to expand Germany’s conventional military strength, Schulz cautioned that civilian resilience is “at least as important as tanks and drones.”

The new law reflects a broader recognition in Berlin: in an era of hybrid conflict, the front line no longer lies only at the border. It runs through power cables, data networks, water systems, and supply chains—and defending them has become a core task of national security.

Editor's Pick

DOJ and Congress Are Looking At Ilhan Omar Amid Minnesota Turmoil

When presidential rhetoric meets federal power, the line between investigation and intimidation grows dangerously thin.

President Donald Trump escalated his confrontation with Rep. Ilhan Omar on Monday, claiming that the Justice Department and Congress are “looking at” the Minnesota Democrat, even as his administration faces mounting backlash over federal operations and deadly incidents in the state.

Trump made the assertion in a Truth Social post announcing that he was dispatching White House border “czar” Tom Homan to Minnesota, saying the administration was probing what he described as “massive fraud” that he blamed, at least in part, for “violent organized protests” in the streets. Without offering evidence, Trump added that federal authorities were examining Omar, alleging that she arrived in the United States “with nothing” and is now “reportedly worth more than $44 million.”

He provided no details about the supposed investigations.

Omar swiftly rejected the claim, framing it as political theater. In a statement posted on X, she accused Trump of panicking as his support weakens and of deflecting from his administration’s failures with “lies and conspiracy theories.” “Years of ‘investigations’ have found nothing,” she wrote. “Get your goons out of Minnesota.”

The Justice Department did not immediately respond to requests for comment, and neither congressional leadership office confirmed any inquiry tied to Trump’s remarks.

The episode is the latest turn in a campaign of attacks Trump has directed at Omar, the first Somali American elected to Congress, and at Minnesota’s broader Somali-American community. In recent weeks, as outrage has grown over aggressive federal immigration enforcement in the Minneapolis area — including the fatal shootings of Alex Pretti and Renee Nicole Good — Trump and his allies have revived fraud allegations involving Somali-run daycare centers and linked them to Omar without substantiating evidence.

Trump has repeatedly questioned Omar’s personal wealth, claiming on social media that she holds tens of millions of dollars. Omar has publicly disputed those figures. In a video last September, she noted that conservative claims about her net worth fluctuate wildly and misrepresent her financial disclosures. Her 2024 report listed business interests tied to her husband, including Rose Lake Capital LLC, valued between $5 million and $25 million, and ESTCRU LLC, valued between $1 million and $5 million — neither of which reflected direct personal income for Omar beyond modest amounts.

The political context surrounding Trump’s claims is striking. Omar is not the only Minnesota Democrat now in federal crosshairs. NBC News reported last week that the Justice Department subpoenaed Gov. Tim Walz, Minneapolis Mayor Jacob Frey, and other state leaders as part of an investigation into whether officials obstructed federal immigration operations. Walz dismissed the probe as “political theater,” while Frey accused the administration of weaponizing its power to intimidate local leaders.

Those Minnesota inquiries follow a pattern: a series of probes targeting Trump’s most vocal Democratic critics nationwide.

For supporters, the administration’s moves signal toughness on immigration and fraud. For critics, they reflect a troubling fusion of presidential grievance and federal authority — one that risks blurring the boundary between legitimate law enforcement and political retaliation.

As Minnesota reels from both tragedy and tension, Trump’s latest salvo against Ilhan Omar ensures that the state remains not only a site of federal operations, but a front line in America’s deepening political divide.

Editor's Pick

India–EU Seal Landmark Free Trade Deal Creating a Market of Two Billion People

Modi and Europe Rewrite Global Trade: The World’s Biggest Free-Trade Zone Is Born. As Washington wavers, India and Europe redraw the map of global trade.

India and the European Union have finalized a landmark free trade agreement that will forge one of the world’s largest economic zones, covering nearly two billion people and close to a quarter of global GDP — a deal that arrives as the global trading system faces its most severe stress in decades.

Prime Minister Narendra Modi announced the agreement at an India–EU summit co-chaired by European Council President António Costa and European Commission President Ursula von der Leyen, calling it “the mother of all deals” and declaring it would unlock major opportunities for India’s 1.4 billion people and millions across Europe.

The pact, the largest ever signed by either side, will slash or eliminate tariffs on almost 97% of European exports to India, saving EU firms up to €4 billion annually in duties. European exports to India are expected to double by 2032, according to the European Commission.

For Europe’s industrial champions, the concessions are sweeping. Duties on cars will fall from as high as 110% to around 10% over time, with tariffs on auto parts abolished within five to ten years. Levies on machinery, chemicals, and pharmaceuticals will be largely eliminated. Agri-food tariffs, which average more than 36%, will be sharply cut. Wine duties will drop from 150% to 75% initially and eventually to about 20%, while olive oil tariffs will fall to zero within five years. Tariffs on processed foods such as bread and confectionery will disappear entirely.

India, in turn, secures unprecedented access to the European market. The EU will cut tariffs on 99.5% of Indian goods over seven years, bringing duties on marine products, leather, chemicals, rubber, base metals, gems and jewelry down to zero. All imports into the EU will continue to meet Europe’s strict food safety and regulatory standards.

The agreement goes well beyond tariffs. It embeds commitments on climate action, environmental protection, labor rights, and women’s empowerment, and will launch a new EU–India climate cooperation platform in 2026. A €500 million EU fund over two years will support India’s efforts to cut emissions and accelerate sustainable industrial transformation.

Germany’s Vice Chancellor and Finance Minister Lars Klingbeil said the deal would “create new opportunities for growth and good jobs — in Europe and India alike — while deepening the strategic partnership with the world’s largest democracy.”

Behind the celebratory language lies a deeper strategic calculation. As trade tensions rise and U.S. tariff policy grows increasingly unpredictable, both sides are seeking stable, rules-based alternatives. Biswajit Dhar, a trade expert in New Delhi, noted that “global trade rules have been thrown up into the air,” making it vital for India and the EU to turn toward each other not only to protect bilateral trade, but to expand it.

That message is not lost in Washington. U.S. Treasury Secretary Scott Bessent criticized the deal, arguing that Europe was “financing a war against itself” by signing a trade pact with India while seeking to penalize New Delhi for buying Russian oil.

Yet for Brussels and New Delhi, the agreement sends a clear signal: in a fractured global economy, there are still major powers willing to bet on openness, multilateralism, and long-term strategic alignment.

After nearly two decades of stalled talks, the India–EU deal is more than a commercial accord. It is a statement about the future of global trade — and who intends to shape it.

Editor's Pick

Why India Is Poised to Become the Next Major Power to Recognize Somaliland

After Israel, India Steps Forward: Somaliland Emerges as New Pivot in the Indian Ocean.

India is quietly emerging as the most likely next major power to recognize the Republic of Somaliland—and the logic behind the shift is strategic, maritime, and unmistakably geopolitical.

As New Delhi accelerates its push for influence across the Western Indian Ocean and Red Sea, Somaliland has moved from the margins of India’s Africa policy to its center. The driver is not ideology, but competition—above all with China.

At the heart of India’s interest lies Berbera Port.

India’s ambitions align neatly with Somaliland’s geography. Somaliland controls an 850-kilometer coastline along the Gulf of Aden, adjacent to one of the world’s most vital shipping corridors. India already deploys anti-piracy warships in these waters. A deeper relationship with Somaliland would transform patrols into presence—and influence into leverage.

The timing matters. Prime Minister Narendra Modi’s recent visit to Addis Ababa reinforced India’s strategic courtship of Ethiopia, Africa’s largest landlocked market and Somaliland’s primary trade partner. Ethiopia is already shifting major volumes of commerce to Berbera under a historic agreement with Hargeisa. For India, access to Ethiopia via Berbera is not a side benefit—it is the prize.

Indian policy institutions have been explicit: Somaliland is a gateway to counter China’s dominance along East Africa’s coast. New Delhi sees Berbera as a potential commercial hub, logistics corridor, and even future naval foothold—one capable of balancing Chinese and Pakistani-linked influence stretching from the Horn to Mozambique and the Congo.

The political case is equally compelling. Somaliland is stable, democratic, and pro-Western—an anomaly in a volatile region. Its capital, Hargeisa, already hosts consulates and liaison offices from key regional and global players. It recognized Taiwan in 2020, absorbing sustained pressure from Beijing without retreat. That stance has earned quiet admiration in New Delhi, which views Somaliland as a natural partner in the broader Indo-Pacific contest.

Trade ties already exist. Somaliland imports pharmaceuticals, machinery, fuel, vehicles, and consumer goods from India, making New Delhi one of its top trading partners by container volume. What is missing is not commerce—but recognition.

India also sees an opportunity to strengthen its relationship with the UAE, a fellow BRICS member and the principal investor behind Berbera’s expansion and free trade zone. The UAE’s role in co-developing the Berbera Corridor with Ethiopia fits neatly into India’s vision of diversified, non-Chinese supply chains across Africa.

Somaliland cannot hold off Chinese pressure indefinitely on its own. If India wants to prevent Beijing from eventually prying Hargeisa away from Taiwan—and absorbing Berbera into China’s maritime orbit—New Delhi must move decisively.

Recognition would do more than secure influence. It would unlock Indian private investment, boost Somaliland’s economy, and offer African states a visible alternative to China’s debt-driven model. In strategic terms, it would mark the beginning of a pax-India along the East African coast.

Israel broke the diplomatic ice. India now stands at the edge of a consequential decision—one that could redefine the balance of power from the Red Sea to the Indian Ocean, with Somaliland at its center.

Editor's Pick

Hassan Sheikh’s Fatal Obsession: Why Somaliland Haunts Him More Than al-Shabaab

Jealousy in Villa Somalia: Hassan Sheikh’s War Against Somaliland’s Democracy.

Somalia’s President Hassan Sheikh Mohamud has become a prisoner of his own jealousy. Two years into his second term, he has turned Villa Somalia into a war room not against al-Shabaab, famine, or corruption — but against Somaliland’s democracy.

It is the bitter irony of Mogadishu politics: Somaliland has what Hassan Sheikh craves but cannot build. Elections, functioning institutions, stability — the very pillars of a state. And each time Hargeisa strengthens its democracy, Hassan Sheikh’s insecurity deepens. Instead of fixing Somalia’s crumbling foundations, he wastes his energy trying to sabotage Somaliland’s international rise.

Diplomats whisper of a leader consumed by comparison. When Somaliland engages Ethiopia, he panics. When Congress debates travel advisories, he rages. When Somaliland’s army parades discipline, he lashes out with propaganda. It is envy in plain sight.

Meanwhile, Somalia under Hassan Sheikh has become what critics call “Somalia, Inc.” — a company run on begging contracts and aid trips. He has circled the globe signing pledges with Qatar, Turkey, and Egypt, but what has it delivered? More debt, more dependency, and more humiliation. He acts like a traveling salesman while Mogadishu rots under insecurity and corruption.

And yet, he keeps returning to his favorite target: Somaliland. His strategy is one of projection — blame Somaliland, block Somaliland, bury Somaliland. But the more he tries, the more the world notices Hargeisa’s difference. Somaliland is not perfect, but next to Mogadishu’s chaos, it shines.

This obsession is Hassan Sheikh’s fatal flaw. It exposes his weakness, isolates his diplomacy, and leaves Somalia unprepared for the storms ahead. Ethiopia is openly discussing Red Sea access. Egypt and Eritrea are arming Somalia’s fragile government. Al-Shabaab still controls swathes of land. Yet Villa Somalia’s energy is wasted on fighting a neighbor that long ago outpaced it.

The humiliation runs deeper. By attacking Somaliland, Hassan Sheikh admits — without saying it — that Somaliland is real. If it were not, why fear it? Why obsess over it? Why chase every foreign leader to block recognition? His jealousy has become Mogadishu’s foreign policy, and it is destroying him.

And here is the grim prediction: the president after him will be worse. If Somalia survives Hassan Sheikh’s term, it will inherit a broken state, an isolated diplomacy, and an army of resentments. Somaliland, meanwhile, will march on.

Analysis

China’s EUV Breakthrough and the AI Warfare Balance

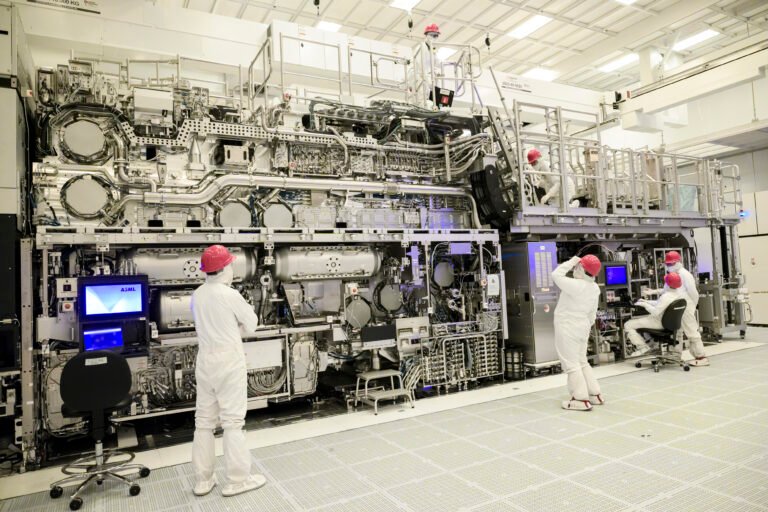

China’s reported development of a prototype extreme ultraviolet (EUV) lithography machine—a critical piece of technology long monopolized by Western firms—may have implications far beyond commercial competition in chips. Sources say that Chinese scientists, including former engineers from Dutch semiconductor equipment maker ASML, assembled a working EUV prototype capable of generating the extreme ultraviolet light needed to etch the tiny circuits used in advanced semiconductor manufacturing.

This marks a significant step toward Beijing’s goal of self-sufficiency in chip production and could reshape how China participates in the global AI and military competition.

Why EUV Matters for AI and Military Power

EUV lithography machines are essential for producing the most advanced chips that power artificial intelligence models, data centers, and high-performance computing—technologies increasingly central to AI-driven military systems and defense capabilities. These chips are a core enabler of autonomous systems, real-time battlefield decision-making, and advanced signal processing. Without access to EUV, a country is effectively shut out of producing the hardware foundations of cutting-edge AI.

For years, export controls by the United States and its allies have restricted China’s access to EUV machines and advanced AI chips precisely because of their dual-use nature—civilian but also critical for military systems. These controls are intended to slow China’s progress in military applications of AI and maintain Western technological superiority.

China’s first EUV prototype suggests it could circumvent some layers of that control, potentially accelerating its ability to internally produce high-end semiconductors that drive AI advances in both commercial and military domains. While the prototype is not yet producing chips, its ability to generate EUV light is a milestone that many analysts believed was years away.

The AI Arms Race and Global Military Balance

Advanced semiconductors are not a luxury—they are strategic military assets. In modern warfare, AI-enabled systems are proliferating rapidly: autonomous drones, sensor networks, real-time command and control, and predictive analytics all depend on advanced chips. As a result, the race for AI superiority overlaps directly with military competition between major powers. Observers often frame this competition as an “AI Cold War,” in which dominance in AI technology and hardware translates into battlefield advantage, deterrence capability, and geopolitical influence.

If China can develop and mass-produce its own advanced chips using domestic EUV technology, it could narrow the technology gap that has so far given the United States and its allies an edge in military AI applications. That includes everything from autonomous systems to real-time battlefield simulations and secure AI-driven cyber defense. The ability to control this part of the supply chain would reduce China’s vulnerability to export controls and strengthen its position in future conflict scenarios where AI plays a decisive role.

Policy and Strategic Implications

For the United States and its partners, this development raises hard questions about the assumptions underlying current export controls and military planning. To date, U.S. efforts have aimed to contain China’s access to critical semiconductor manufacturing tools and advanced AI hardware, seeing this as fundamental to maintaining a strategic advantage across civilian and defense sectors. That strategy is grounded in the belief that access to high-performance computing and AI chips underpins future battlefield success and strategic deterrence.

However, if China continues to close the technological gap—even incrementally—it could force a recalibration of how export controls, multilateral alliances, and technology policy are employed to maintain an AI lead. This shift could also affect allied nations that currently benefit from U.S. chip technology dominance, pushing them to reassess their own semiconductor strategies and defense modernization plans.

Not a Done Deal—Yet

It is important to emphasize that China’s EUV prototype is still not mass-producing chips and remains far less sophisticated than the machines used by industry leaders like TSMC or Intel. Many technical hurdles remain, particularly in optics and production scalability. Critics also note that successfully generating EUV light, while significant, does not automatically translate into full chipmaking capability.

Nevertheless, the development signals that China’s resolve to master the hardest elements of semiconductor manufacturing is stronger than many analysts had expected—underscoring how semiconductor technology is now inseparable from global competition, economic strategy, and military balance.

Conclusion: A New Dimension of the AI Arms Race

China’s reported EUV prototype does not yet rewrite the rules of the global semiconductor landscape, but it does redefine the timeline and stakes. In an era where artificial intelligence increasingly shapes military strategy and operational capability, control over the hardware that fuels AI is no longer a commercial advantage alone—it is a strategic imperative.

As rivals pursue their own national semiconductor goals, the emergence of China’s EUV capabilities could mark the beginning of a more contested, multipolar era in both technology and military power.

-

Interagency Assessment2 months ago

Interagency Assessment2 months agoTOP SECRET SHIFT: U.S. MILITARY ORDERED INTO SOMALILAND BY LAW

-

Somaliland4 months ago

Somaliland4 months agoSomaliland Recognition: US, UK, Israel, and Gulf Bloc Poised for Historic Shift

-

Minnesota1 month ago

Minnesota1 month agoFraud Allegations Close In on Somalia’s Top Diplomats

-

Middle East2 months ago

Middle East2 months agoSaudi Arabia vs. UAE: How The Gulf Rivalry is Heating Up

-

American Somali3 months ago

American Somali3 months agoWhy Frey Won a Significant Share of the Somali Vote Against a Somali Opponent

-

Middle East2 months ago

Middle East2 months agoTurkey’s Syria Radar Plan Triggers Israeli Red Lines

-

Editor's Pick1 month ago

Editor's Pick1 month agoWhy India Is Poised to Become the Next Major Power to Recognize Somaliland

-

The Million-Follower Exile2 months ago

The Million-Follower Exile2 months agoWhy America Deported Its Most Famous Somali TikTok Star And Who Paid The Price